Disaster Field Operations Center West

Release Date: May 22, 2024

Media Contact: Corey D. Williams,

(916) 735-1500, [email protected]

Release Number: TX 20320-02

Follow us on X, Facebook, Blogs & Instagram

SBA to Open Business Recovery Centers in Houston

SACRAMENTO, Calif. – Francisco Sánchez Jr., associate administrator for the Office of Disaster Recovery and Resilience at the Small Business Administration, today announced the openings of two Business Recovery Centers to meet the needs of businesses and residents who were affected by severe storms, straight-line winds, tornadoes and flooding that began on April 26.

“As a lifelong Houstonian, this city isn’t just home; it’s part of who I am. Witnessing the devastation brought by the recent derecho, with fierce winds and tornadoes tearing through our communities, has been heart-wrenching. The loss of eight lives is a profound tragedy and knowing that so many of our neighbors are still without power deepens my resolve. Houston is home, and it’s our resilience as a community that will guide us through this recovery,” said Sánchez.

The Business Recovery Centers will be located at University of Houston – Downtown, Marilyn Davies College of Business and at Trini Mendenhall Community Center. Both Business Recovery Centers will be open beginning Thursday, May 23, in Houston.

“SBA customer service representatives will be on hand at the following centers to answer questions about SBA’s disaster loan program, explain the application process and help each individual complete their electronic loan application,” Sánchez continued. The centers will be open on the days and times indicated. No appointment is necessary.

HARRIS COUNTY

Business Recovery Center

University of Houston – Downtown

Marilyn Davies College of Business

Room B106, 1st Floor

320 North Main St.

Houston, TX 77002

Parking is underneath the Marilyn Davies

College of Business in the Shea Street Building

Opens at 9 a.m. Thursday, May 23

Mondays – Fridays, 9 a.m. – 6 p.m.

Saturdays, 9 a.m. – 4 p.m.

Closed Monday, May 27 in Observance of Memorial Day

HARRIS COUNTY

Business Recovery Center

Trini Mendenhall Community Center

1414 Wirt Rd.

Houston, TX 77055

Opens at 1 p.m. Thursday, May 23

Mondays – Fridays, 9 a.m. – 6 p.m.

Saturdays, 9 a.m. – 4 p.m.

Closed Monday, May 27 in Observance of Memorial Day

For business owners and residents who are unable to visit the Business Recovery Centers, the following Virtual Business Recovery Center is also available to assist small businesses and residents with their applications.

VIRTUAL BUSINESS RECOVERY CENTER

Monday – Friday

8:00 a.m. – 4:30 p.m.

[email protected]

(916) 932-8925

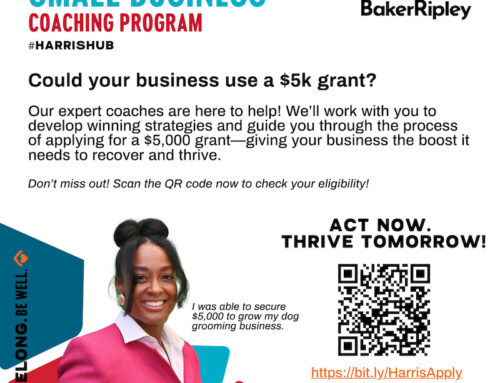

The University of Houston Texas Gulf Coast Small Business Development Centers are offering free, personalized counseling to help affected businesses in their recovery. Businesses may find a University of Houston Texas Gulf Coast SBDC location nearest to them online at http://www.sbdc.uh.edu or by calling (713) 752‑8444 to request consultation. Visitors are encouraged to call first for an appointment.

UH Texas Gulf Coast business advisors will provide business assistance to clients on a wide variety of matters designed to help small business owners re-establish their operations, overcome the effects of the disaster and plan for their future. Services include assessing business working capital needs, evaluating the business’s strength, cash flow projections, and most importantly, a review of options with the business owner to help them evaluate their alternatives and make decisions that are appropriate for their situation.

Businesses of all sizes and private nonprofit organizations may borrow up to $2 million to repair or replace damaged or destroyed real estate, machinery and equipment, inventory and other business assets. SBA can also lend additional funds to help with the cost of improvements to protect, prevent or minimize disaster damage from occurring in the future.

For small businesses, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations of any size, SBA offers Economic Injury Disaster Loans to help meet working capital needs caused by the disaster. Economic injury assistance is available to businesses regardless of any property damage.

These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact. Disaster loans can provide vital economic assistance to small businesses to help overcome the temporary loss of revenue they are experiencing.

Disaster loans up to $500,000 are available to homeowners to repair or replace damaged or destroyed real estate. Homeowners and renters are eligible for up to $100,000 to repair or replace damaged or destroyed personal property, including personal vehicles.

Interest rates can be as low as 4 percent for businesses, 3.25 percent for private nonprofit organizations and 2.688 percent for homeowners and renters with terms up to 30 years. Loan amounts and terms are set by SBA and are based on each applicant’s financial condition.

The disaster declaration makes SBA assistance available in Calhoun, Eastland,Guadalupe, Hardin, Harris, Jasper, Jones, Lamar, Liberty, Montgomery, Polk, San Jacinto, Trinity, Walker and Waller counties.

Interest does not begin to accrue until 12 months from the date of the first disaster loan disbursement. SBA disaster loan repayment begins 12 months from the date of the first disbursement.

In addition, applicants may apply online and receive additional disaster assistance information at SBA.gov/disaster. Applicants may also call SBA’s Customer Service Center at (800) 659-2955 or email [email protected]

The deadline to apply for physical damage is July 16, 2024. The deadline to apply for economic injury is Feb. 18, 2025.

Disaster Assistance Guide

Disaster Assistance Key Facts

- Businesses of all sizes and private nonprofit organizations may borrow up to $2 million to repair or replace damaged or destroyed real estate, machinery and equipment, inventory and other business assets. SBA can also lend additional funds to help with the cost of improvements to protect, prevent or minimize disaster damage from occurring in the future.

- These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact.

- Interest rates can be as low as 4 percent for businesses, 3.25 percent for private nonprofit organizations and 2.688 percent for homeowners and renters with terms up to 30 years. Loan amounts and terms are set by SBA and are based on each applicant’s financial condition.

- In addition, applicants may apply online and receive additional disaster assistance information at SBA.gov/disaster. Applicants may also call SBA’s Customer Service Center at (800) 659-2955 or email [email protected]

ov for more information on SBA disaster assistance. For people who are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services. - The deadline to apply for physical damage is July 16, 2024. The deadline to apply for economic injury is Feb. 18, 2025.

- The disaster declaration makes SBA assistance available in Calhoun, Eastland, Guadalupe, Hardin, Harris, Jasper, Jones, Lamar, Liberty, Montgomery, Polk, San Jacinto, Trinity, Walker and Waller counties.

- Contiguous Counties (other counties that may have been affected): Angelina, Aransas, Austin, Bexar, Brazoria, Brown, Caldwell, Callahan, Chambers, Comal, Comanche, Delta, Erath, Fannin, Fisher, Fort Bend, Franklin, Galveston, Gonzales, Grimes, Haskell, Hays, Houston, Jackson, Jefferson, Madison, Matagorda, Newton, Nolan, Orange, Palo Pinto, Red River, Refugio, Sabine, San Augustine, Shackelford, Stephens, Stonewall, Taylor, Tyler, Victoria, Washington, Wilson

Additional helpful links: